2024 Business Entertainment Deduction – The Internal Revenue Service (IRS) has just released the updated income tax brackets for 2024, enabling individuals . The 2023 standard deduction is $13,850 for a flat rate of $50 in 2024, credit score tracking, personalized recommendations, timely alerts, and more. Certain business, medical or moving mileage. .

2024 Business Entertainment Deduction

Source : www.amazon.com

Florida Accounting & Advisers | Boca Raton FL

Source : www.facebook.com

Properly Substantiated Meal and Entertainment Expenses Are

Source : www.wolterskluwer.com

Lower Your Taxes BIG TIME! 2019 2020: by Botkin, Sandy

Source : www.amazon.com

Business Meals and Entertainment Expenses: What’s deductable?

Source : financialsolutionadvisors.com

Lower Your Taxes BIG TIME! 2023 2024: Small Business Wealth

Source : www.amazon.com

Business Meals and Entertainment Expenses: What’s deductable?

Source : financialsolutionadvisors.com

Amazon.com: Lower Your Taxes BIG TIME! 2023 2024: Small Business

Source : www.amazon.com

Cindy Janka CPA | Yukon OK

Source : www.facebook.com

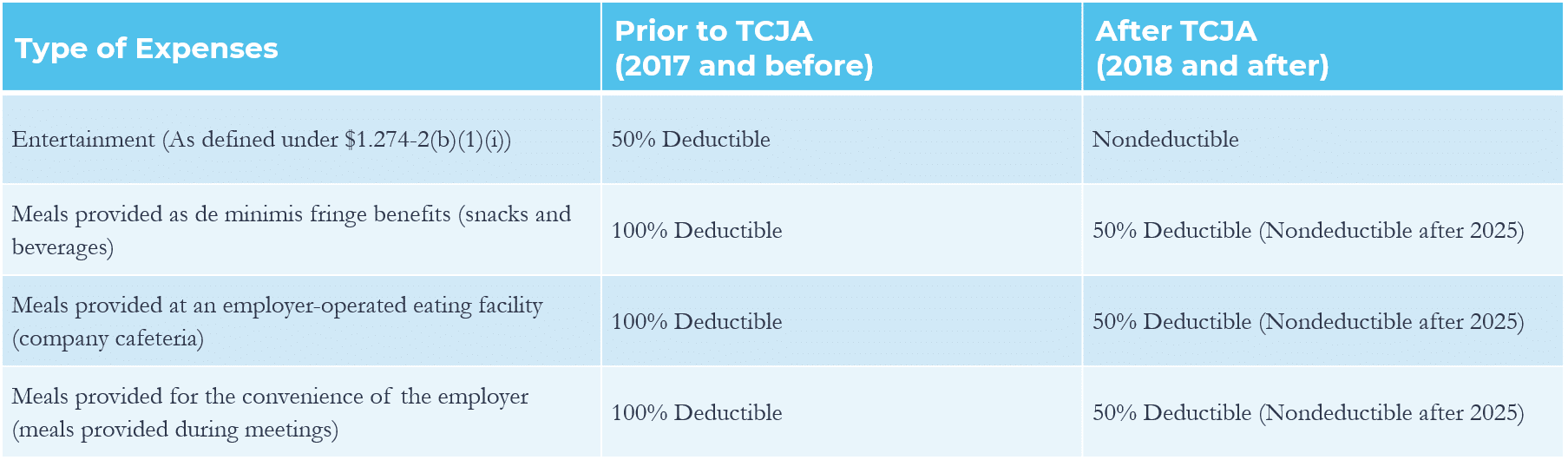

Navigating the New Meals and Entertainment Deductions under TCJA

Source : www.grfcpa.com

2024 Business Entertainment Deduction Lower Your Taxes BIG TIME! 2023 2024: by Botkin, Sandy: The IRS has released the 2024 standard deduction amounts that you’ll use for your 2025 tax return. Knowing the standard deduction amount for your filing status can help you determine whether you . General tax rules say that if you incur entertainment expenses related to your business, you can deduct those expenses if the following are true: The activity provided amusement or recreation .